Public Liability Insurance for your business

Public Liability Insurance for your business

Premiums are risk profile dependent and subject to annual review.

Premiums are risk profile dependent and subject to annual review.

Stay protected from

unexpected accidents

Stay protected from

unexpected accidents

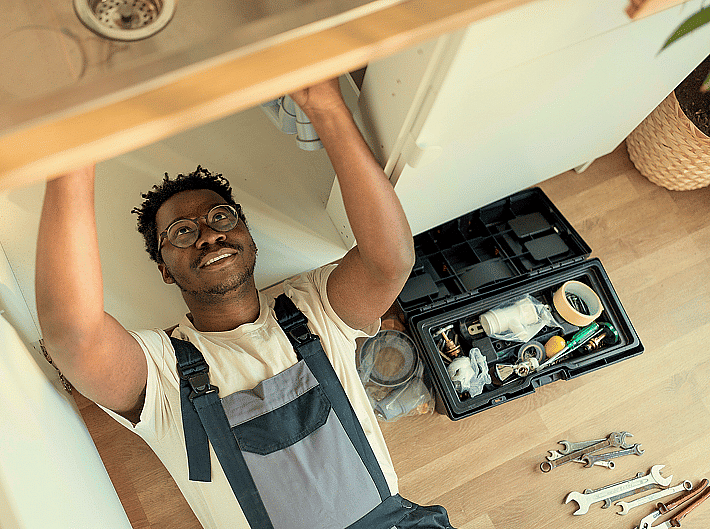

Auto & General Public Liability Insurance provides vital protection against the potential financial impact of unexpected events. Our comprehensive cover helps protect your business if a third party is injured or their property is damaged as a result of your work. This means you can focus on growing your business with less worry about the risks that come with everyday operations. Build your business with confidence, peace of mind and affordable protection.

When you take out an Auto&General Business Insurance Policy, you'll also get access to Auto&General Biz Assist, a complimentary suite of support services designed to help small to medium sized enterprises (SMEs) in South Africa thrive.

What is Public Liability Insurance?

Public Liability Insurance is there to protect your business when things do not go as planned. It covers you if you are found legally responsible for causing injury to a third party or damage to their property.

Whether the incident happens at your business premises or while your employees are working at a client's location, this insurance steps in. It ensures that you have support when a claim arises from negligence during the normal course of your insured business activities.

Auto & General Public Liability Insurance provides vital protection against the potential financial impact of unexpected events. Our comprehensive cover helps protect your business if a third party is injured or their property is damaged as a result of your work. This means you can focus on growing your business with less worry about the risks that come with everyday operations. Build your business with confidence, peace of mind and affordable protection.

When you take out an Auto&General Business Insurance Policy, you'll also get access to Auto&General Biz Assist, a complimentary suite of support services designed to help small to medium sized enterprises (SMEs) in South Africa thrive.

What is Public Liability Insurance?

Public Liability Insurance is there to protect your business when things do not go as planned. It covers you if you are found legally responsible for causing injury to a third party or damage to their property.

Whether the incident happens at your business premises or while your employees are working at a client's location, this insurance steps in. It ensures that you have support when a claim arises from negligence during the normal course of your insured business activities.