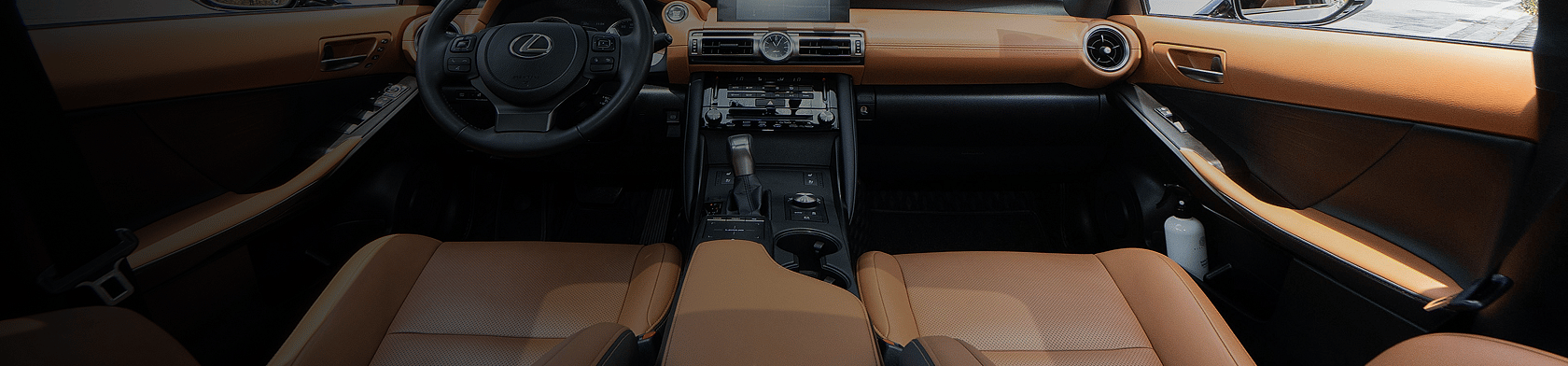

Auto Top-Up Plus

cover that pays your credit shortfall.

Did you know that when your car is stolen or written off, your comprehensive insurance claim payout might be less than the amount you still owe to the bank for your financed car?

That means you could be left paying the credit shortfall — the difference between your insurer’s payout and the original financed amount.

Auto Top-Up Plus from Auto&General helps cover that shortfall, so you don’t have to stress. We understand that unforeseen events happen — and we’re here to help you stay prepared.

With built-in benefits like personal accident cover, it's not just about covering costs - it’s about protecting your wellbeing too. You can also add optional benefits, such as Instalment Protector, for an additional cost if you want even more peace of mind.