Everything You Need to Know about Comprehensive Car Insurance Covers

motor

Navigating the world of car insurance can be challenging, especially when coming across terms like “comprehensive car insurance.” You might feel frustrated and wind up investing in a product that completely lets you down in your time of need.

This guide aims to clarify what comprehensive car insurance is all about, its cover options, and why it’s important for you and your car.

What is Comprehensive Car Insurance?

Comprehensive car insurance is a type of insurance that covers vehicle owners against a wide range of risks. Unlike third-party insurance, which only covers damages inflicted on others when you are at fault in an accident, comprehensive insurance extends cover to your own vehicle, irrespective of who is at fault.

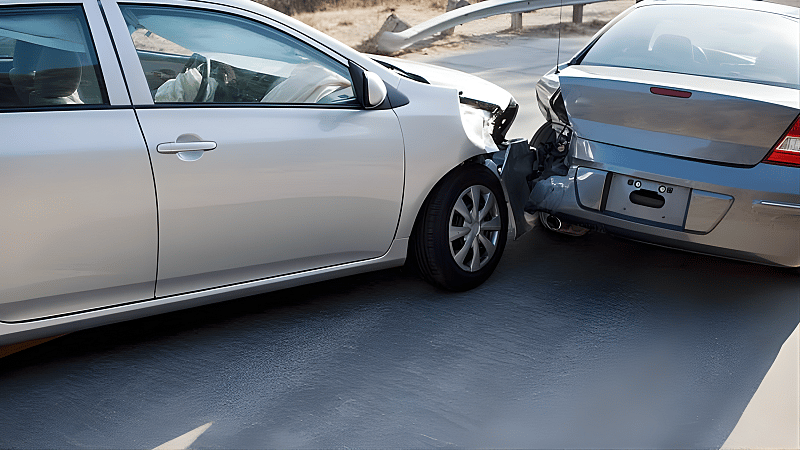

For instance, consider a scenario where your vehicle is involved in a car accident. Without comprehensive insurance, you would have to pay out of pocket for all repairs, which could be substantial. However, with comprehensive cover, those expenses would be taken care of by your insurer, saving you both time and money during an already stressful situation.

What Does Comprehensive Car Insurance Cover?

Comprehensive car insurance typically includes coverage for the following incidents:

1. Accident damage: If your car is damaged in an accident, regardless of who’s at fault, comprehensive car insurance covers the repairs or replacement.

2. Theft: If your vehicle is stolen, comprehensive insurance can assist in recovering the associated costs. Theft can be a distressing experience, and having coverage can mitigate the financial impact.

3. Vandalism: Damage caused by acts of vandalism, such as keying or broken windows, is generally covered. This type of protection ensures that you are not left to bear the costs of malicious actions by others.

4. Natural Disasters: Comprehensive insurance covers damages resulting from natural disasters, including floods, hail, and falling trees. Such incidents can cause extensive damage, and having insurance can provide necessary financial relief.

5. Fire: Cover extends to damages from fires, whether caused by mechanical failure or external factors. This is essential, as vehicle fires can lead to total loss.

6. Animal Collisions: If your vehicle collides with an animal, such as large cattle, comprehensive insurance typically covers the resulting damage. This is particularly relevant for those who frequently drive in rural areas.

7. Glass Damage: Many comprehensive policies cover the repair or replacement of damaged windows and windshields. Given that glass damage can occur from various sources, this coverage is invaluable.

8. Falling Objects: If your vehicle is damaged by falling objects, such as tree branches or debris, comprehensive insurance can cover the repair costs. This aspect of coverage highlights the unpredictable nature of potential risks.

9. Civil Disturbance (Optional SASRIA cover): If your vehicle sustains damage during civil unrest, comprehensive insurance can assist in covering those costs. This protection underscores the importance of being prepared for unforeseen circumstances.

How Does Comprehensive Car Insurance Work?

The process of using comprehensive car insurance is straightforward. In the event of an incident, the policyholder must file a claim with their insurance provider, detailing the circumstances. A loss adjuster will then assess the damage, and the insurance company will determine the payout based on the policy limits and excess.

For example, imagine your vehicle incurs R7,000 in damages from a hailstorm, and your policy includes a R2,500 excess that you have to pay upfront. Your insurer would then cover the remaining R4,500. Although paying the excess may feel inconvenient, it's far less financially burdensome than covering the full cost of repairs out of pocket.

Why Choose Auto&General Comprehensive Car Insurance?

Auto&General offers tailored comprehensive car insurance options designed to meet the diverse needs of vehicle owners. Our customizable coverage allows policyholders to select the cover that best suits their individual circumstances.

Additionally, Auto&General is known for excellent customer service, with trained representatives ready to help. Our easy-to-use online platform lets you manage your policy, get quotes, and file claims quickly. With over 30 years of experience packed into the Auto&General app, you’re always supported, including AutoSOS, which detects serious accidents and sends emergency help to your location.

The Importance of Comprehensive Coverage

Having comprehensive car insurance provides peace of mind, knowing that you’re covered against a wide variety of risks, from accidents and theft to natural disasters. It’s a smart choice for vehicle owners who want complete cover for their assets.

There are numerous stories from individuals who have faced unfortunate circumstances without comprehensive cover. For instance, should one experience vehicle theft without adequate insurance, they could face substantial financial repercussions. This scenario highlights the importance of being properly insured.

Get Covered with Auto&General

Comprehensive car insurance is a prudent choice for vehicle owners seeking to protect their assets. It covers a wide range of incidents, from theft to natural disasters, providing essential peace of mind while on the road. Auto&General’s comprehensive car insurance options are designed to accommodate various lifestyles and needs, making it easier for individuals to find the appropriate coverage.

If you are considering car insurance or you’d like to understand the benefits of comprehensive coverage, get in touch with us and we’ll call you back.

Being prepared for potential risks can save you from significant financial distress in the future. Get a quote now.

FAQs

What is the difference between comprehensive and third-party car insurance?

Comprehensive car insurance provides coverage for damages to your own vehicle and a variety of risks, while third-party insurance only cover damages you cause to other vehicles.

Does comprehensive car insurance cover rental cars?

Typically, comprehensive insurance does not extend to rental cars unless specific rental coverage is included in your policy. Always verify your policy details.

How can I lower my comprehensive car insurance premium?

Premiums can be reduced by increasing your excess, maintaining a clean driving record, or bundling your car insurance with other products, like building or home contents cover.

Is comprehensive car insurance mandatory?

Yes, comprehensive car insurance is mandatory for financed vehicles.

What should I do if I need to file a comprehensive insurance claim?

If you need to file a claim, the quickest way is through our Auto&General mobile App. You can also submit a claim by calling us on 0861 60 01 24.

Disclaimer: Auto and General is an authorised non-life insurer and financial services provider. Our content is written by a Compare the Market expert, backed by data and enhanced by AI. The information in this article is provided for informational purposes only and should not be construed as financial, legal, or medical advice. Terms and Conditions Online.