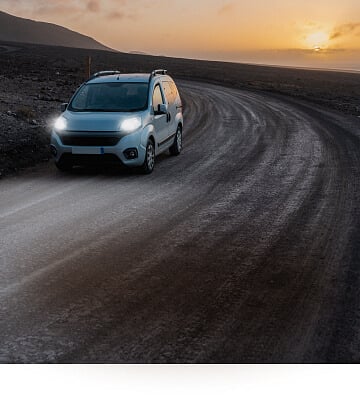

Get Covered with Third Party, Fire & Theft Car Insurance

Looking for cover that strikes the right balance between protection and affordability? Third-party Fire and Theft is a great mid-range option that safeguards you against two major risks: theft and fire damage. If your vehicle is stolen and not recovered, or damaged due to a fire, you can submit a claim to help cover the cost of repairing or replacing it.

In addition to theft and fire protection, this Third-party Fire and Theft includes third-party liability cover. That means if you’re involved in an accident and it’s your fault, your insurer will handle the third-party claim, covering the cost of damage to the other person’s car or property. You won’t have to pay out of pocket for someone else’s losses.

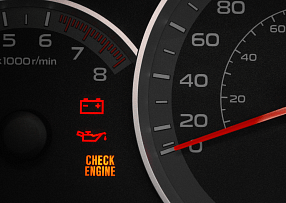

It’s worth noting, though, that Third-party Fire and Theft Insurance does not include cover for accident-related damage to your own car. If your vehicle is damaged in a crash, repairs will be at your own expense unless you have comprehensive insurance.

South Africa sees nearly 20,000 vehicle thefts every year, making theft cover an essential part of any Car Insurance plan. Fire damage is also more common than many drivers realise. That’s why Third-party Fire and Theft offers peace of mind where it matters most.

Need more protection? You can also increase your third-party cover to better handle unexpected claims that fall outside of the standard policy, ensuring you’re fully prepared for life’s surprises on the road.

Our customers generally score us 9.2 out of 10 when asked how easy it was to interact with us.

Fire and theft cover

If a fire causes accidental damage or destruction to your vehicle, we will pay to repair or replace it.

Nearly 20,000 cars are stolen in South Africa every year. Theft coverage remains an essential component of any insurance policy. With our Third Party, Fire & Theft cover, you can claim the cost of replacing a vehicle that has been stolen.

Third party liability cover

We protect you from any liability that may arise if your vehicle accidentally causes damage to someone else's property. We will also pay for the repair or replacement of any other vehicle involved in the accident.

However, this cover does not extend to treating injuries suffered by the other driver or passengers in any vehicle involved in a collision. For additional peace of mind, we can increase your third party cover to ensure you are completely protected in the instance that one of these claims arises.

It Pays to be Loyal

When you choose Comprehensive Car Insurance from A&G, you can rest easy - but it's even better when your careful driving is recognised. Stay claim-free for four years and receive a cash reward from us. To enjoy this benefit, simply add Cash Back Plus to your policy.

Road Assist

We've got you covered if you need emergency roadside support. Our Third Party, Fire & Theft insurance includes Road Assist, which covers you for breakdown and accident assistance.

We provide up to three call-outs per year for mechanical or electrical breakdowns. If you’re in a collision, you can rest assured that we will tow your vehicle from the scene and pay for any subsequent storage costs.

What is Third-party, Fire and Theft?

It’s a Car Insurance policy that covers you if your vehicle is stolen, damaged by fire, or if you cause damage to another person’s property. It doesn’t cover accidental damage to your own car.

How much is Third-party Fire and Theft Insurance?

Premiums are generally lower than Comprehensive Insurance and vary based on your car’s value, location, driving history, and risk profile. Auto&General offers personalised Third-party Fire and Theft quotes to match your needs and budget.

How does a third-party claim work?

If you cause an accident that damages someone else’s vehicle or property, they can make a claim against your insurance. In such a case, Auto&General handles the process and pays out for their losses, so you’re not personally liable.

Who is the third party in insurance?

The third party is anyone who suffers loss or damage due to your actions but isn’t listed on your policy. In car insurance, it’s usually the other driver or property owner involved in an accident you caused.

What is the difference between third party, fire and theft, and comprehensive insurance?

Third party, fire & theft is typically less expensive than comprehensive insurance. If you have an older car model or want to keep your insurance premiums low, third party, fire and theft cover may provide adequate protection. Comprehensive insurance covers additional risks such as accidental damage (even if the collision is your fault).

Car Accessory Insurance Policies

Keep your wheels and rims protected against unexpected road hazards, including puncture repairs, wheel alignment and more

Unexpected chips, minor dents and light scratches happen, and they can be expensive to fix. Choose our Scratch & Dent Protection cover to help your car look as good as new.

A mechanical breakdown can be extremely inconvenient, not to mention costly. That’s why we offer Mechanical Breakdown Cover to help in the event of mechanical or electrical failure

Personal Accident Cover is there for you when you need it. If you are hospitalised, disabled or pass away as a result of an accident, we will make sure you and your family are taken care of.

Read our Car Insurance Blogs

Why SUVs are the most sought after family vehicles in SA

Anyone who has had a bad experience on the road knows that car insurance is an absolute necessity. Paying for repairs to your car or having to buy a new one if yours is written off is simply not an affordable option for most people. However, even though you know you need it, you might still begrudge paying for it a little bit. That is why looking for ways to lower your monthly insurance premium could bring some relief. There are many factors that affect your insurance costs, but did you know your relationship status is one of them?

Myth or fact: Families pay less for car insurance than singles

Anyone who has had a bad experience on the road knows that car insurance is an absolute necessity. Paying for repairs to your car or having to buy a new one if yours is written off is simply not an affordable option for most people. However, even though you know you need it, you might still begrudge paying for it a little bit. That is why looking for ways to lower your monthly insurance premium could bring some relief. There are many factors that affect your insurance costs, but did you know your relationship status is one of them?

4 Ways to Get the Best ROI from Your Business Car Insurance

Whether you're a small business owner with two employees or running a growing company with more than 20, every rand you invest needs to count. If you rely on business vehicles to keep operations running smoothly, you'll need Car Insurance that delivers the best value.